The down payment is the amount that you, the buyer are paying in cash for the house. If you put a deposit on the house when your offer was accepted, the deposit can become part of your down payment. The remainder of the house price is paid by the lender. That borrowed about is the mortgage.

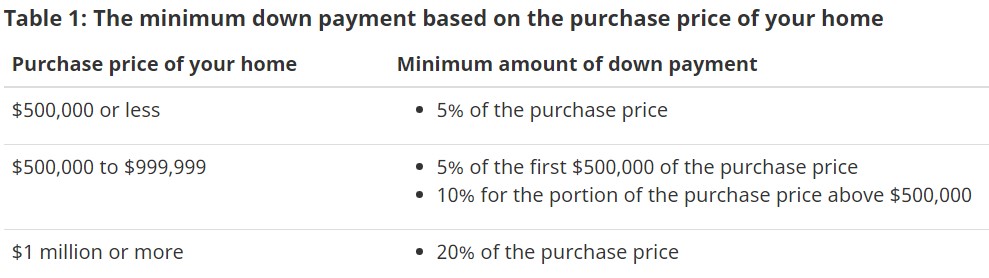

The government mandates a minimum down payment depending on the price of the home.

For low down payment mortgage (less than 20% down), you are required to purchase mortgage default insurance. If the home is $1 million or more, than mortgage default insurance is not available.

Mortgage default insurance protects the lender in case you cannot pay your mortgage payments. The cost of this insurance depends on the total amount borrowed but it is usually added to the mortgage so you do not have to pay this cost up front.